Swing trading is a trading style focused on capturing momentum moves over the course of days or weeks. Swinger traders

are usually attempting to capture one or two waves of a price move,

instead of the entire trend, which could last for months or years. There

are multiple ways to find swing trades, including breakouts, the aftermath of news events or announcements, or bounces off support or resistance. Here are four potential swing trades based on a variety of market conditions.

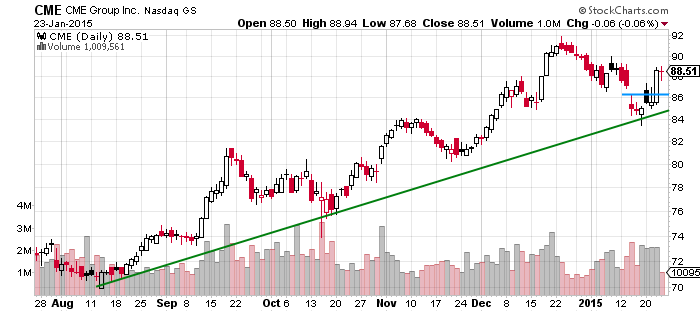

CME Group Inc. (CME) has been rallying in a trend channel

since August, and it recently bounced off channel support near $85. The

price moved aggressively higher off this level on Jan. 22, so wait for a

pullback between $86.25 and $85.75 to buy. Waiting for a pullback may

mean missing a trade, but it makes the risk/reward on the trade much

more attractive. Place a stop loss below the Jan. 16 swing low of

$83.43. A conservative target is $92.60, which is below the Dec. 23 high

of $93.91. A more aggressive target is $94.40, just above the former

high.

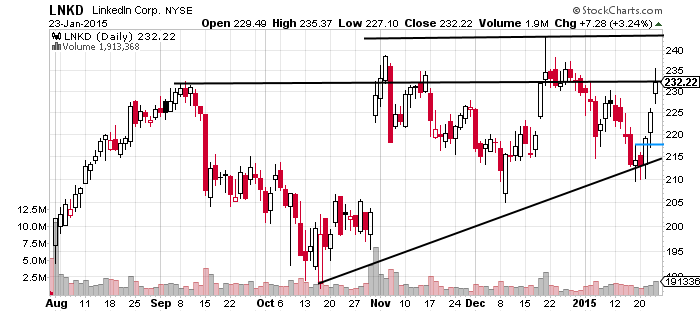

LinkedIn Corp. (LNKD) is moving into the resistance zone of a triangle pattern

which started in September. The top of the triangle has been tested

three time and isn't well defined, forming a resistance area between

$232 and $243.25. Because of this wide resistance area, a legitimate

breakout level is harder to pinpoint. In such cases, here are two

possible ways to trade the triangle. The first is to wait for a pullback

and try to buy near triangle support at $216. Alternatively, if the

price breaks above $243.25, and it runs to at least $250, then buy a

pullback near the original breakout point of $243. If the price

ultimately does break above the triangle the target is $275, with a more

aggressive target of $295. A stop loss on the long position(s) goes

below the most recent swing low.

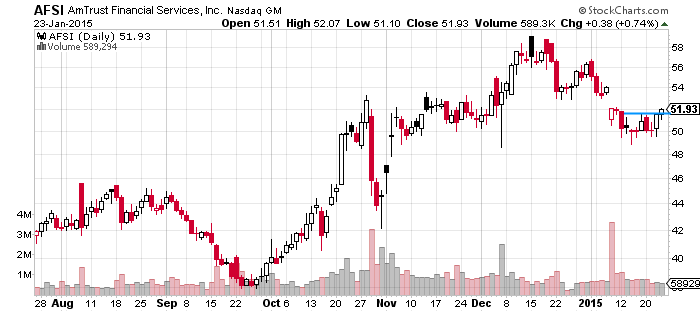

AmTrust Financial Services, Inc. (AFSI)

is in a strong uptrend and recently pulled back to minor support near

$50. The stock paused in this area from Jan. 14-22, ranging between

$48.85 and $51.57. On Jan. 23, the price broke above this consolidation,

indicating another potential advance. Buy near $51.60, with a stop loss

below the consolidation low. A conservative price target is $58; a more aggressive target is $61, beyond the Dec. $59.31 high.

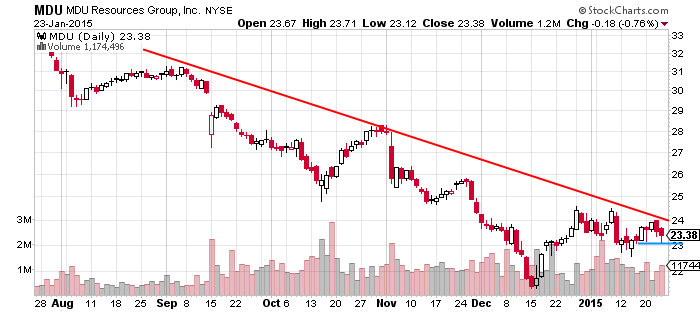

MDU Resources Group Inc. (MDU)

is in a downtrend, channeling lower since the start of July. In

mid-December the stock rallied to the top of the descending trend

channel and has been consolidating there since. A drop below $23.10

pushes the price below a portion of that consolidation and could be

enough to trigger more selling moving the price back toward the channel

bottom. A stop loss

goes above $24, the Jan. 22 high, or alternatively, above $24.58, the

Dec. 29 high. The target for the next wave lower is $20.75; a more

aggressive target is $20.

The Bottom Line

Swing trading provides a way to capture moves which could last a

couple days to a couple weeks (sometimes longer). There are multiple

ways to capture moves, such as breakouts, buying bounces off support

during an uptrend, or shorting when the price declines off resistance in

a downtrend. Stop loss orders help limit risk, but losses can still be

bigger than expected if the price gaps

through the stop loss price. Profit targets are used as a way to make

risk/reward assessments before a trade is made. Alternatively, use a trailing stop.

Sometimes a trailing stop will result in larger gains than a profit

target, but other times the profit target will work better. Choose a

profit taking method when you create your swing trading plan, then stick to it.